Property Purchase: The price of a property you are purchasing.

Purchase Price: The actual current value of a property. The market value is not necessarily equal to the purchase price.

Market Value: The estimated market value of a property after its rehab is complete.

After Repair Value (ARV): The estimated market value of a property after its rehab is complete.

Purchase Costs: All costs and fees associated with purchasing a property.

Rehab Costs: Expenses that you expect to pay after purchasing a property to improve its condition or perform repairs.

Total Cash Needed: The total amount of cash or capital you will need to purchase and rehab a property.

Total Cash Invested: The total amount of capital you have invested in a property.

Purchase Criteria:

- 1% Rule (Rental Properties): According to this rule, the rent to value ratio of a rental property should be 1% or higher.

- 2% Rule (Rental Properties): According to this rule, the rent to value ratio of a rental property should be 2% or higher.

- 50% Rule (Rental Properties): According to this rule, the operating expenses of a rental property should be less than or equal to 50% of its operating income.

- 65% Rule (House Flips): According to this rule, the purchase price of a property you’re flipping should be less than or equal to 65% of its after repair value (ARV), minus the rehab costs you expect to have.

- 70% Rule (House Flips): According to this rule, the purchase price of a property you’re flipping should be less than or equal to 70% of its after repair value (ARV), minus the rehab costs you expect to have.

Financing:

- Down Payment: The portion of the property’s purchase price, and sometimes also the rehab costs, that you need to pay up-front.

- Loan Amount: The portion of the purchase price, and sometimes also the rehab costs, that will be financed and paid by your lender.

- Loan Payments: The recurring payments you will be required to make to your lender to repay your loan.

- Loan Interest: The portion of the loan payment that goes toward paying the interest on a loan.

- Mortgage Insurance (PMI): Costs associated with private mortgage insurance, typically calculated as a percentage of the starting loan amount.

- Refinance Costs: All costs and fees associated with refinancing a property.

Cash Flow:

- Gross Rent: The total rent collected from your tenants, before subtracting any operating expenses or accounting for vacancy.

- Vacancy Expense: The amount you will lose in a given time period due to vacancy.

- Other Income: Any miscellaneous income you expect to receive from a rental property, other than rent.

- Operating Income: Total income generated by a rental property, less the vacancy expense.

- Operating Expenses: All expenses you will have while renting out a property, excluding any loan payments.

- Holding Costs: All recurring expenses you will have while rehabbing a property during a house flip.

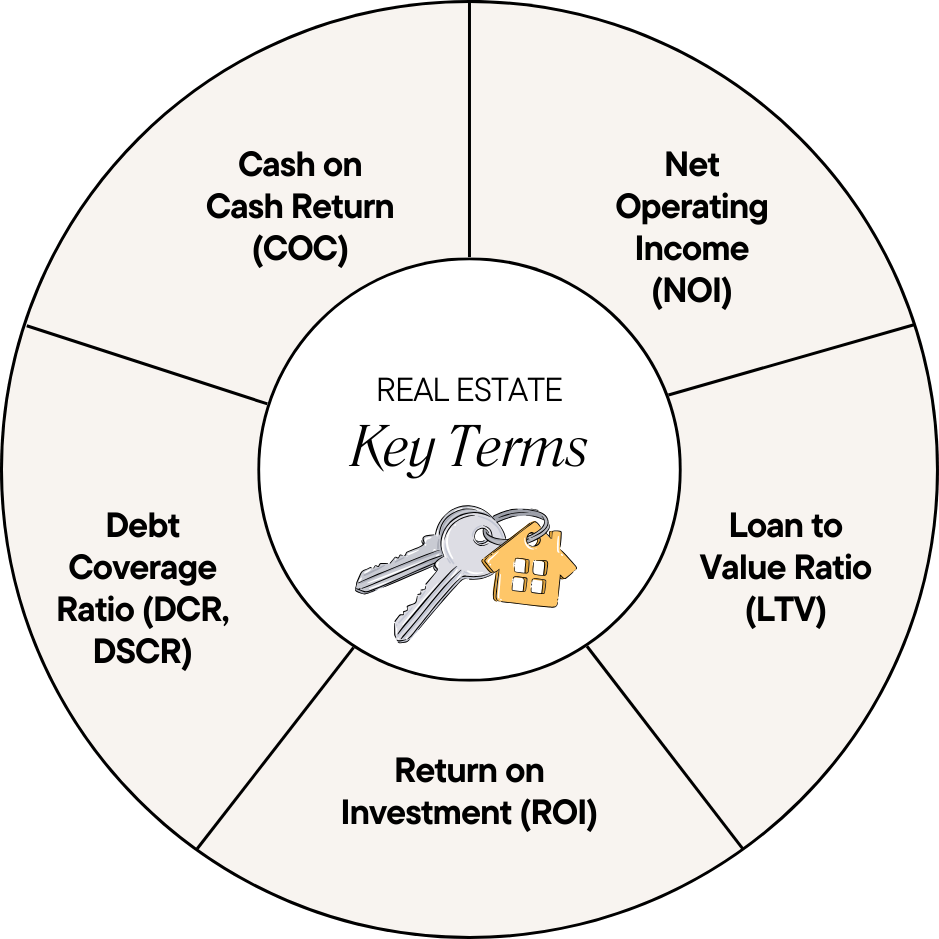

- Net Operating Income (NOI): Net income generated by a rental property.

- Cash Flow: The total net amount you will receive from a rental property as income.

Depreciation: The cost of purchasing and rehabbing a property deducted on your income tax return.

Land Value: The appraised value of the land, excluding any structures or improvements, of a property.

Total Equity: The actual portion of a property’s market value that you own.

Property Sale: All costs and fees associated with selling a property.

Selling Costs: Costs associated with selling a property.

Total Profit (Rental Properties): The total cumulative profit you will receive if you were to sell a rental property that you own.

Total Profit (House Flips): The total net amount you will receive as profit from a house flip after selling the property.

Total Profit (Wholesale): The total net amount you will receive as profit from a wholesale transaction.

Investment Returns:

- Capitalization Rate (Cap Rate): A rate of return of a rental property based on comparing the yearly net operating income (NOI) to the purchase price or market value.

- Cash on Cash Return (COC): A rate of return of a rental property based on comparing the yearly cash flow to the total invested cash.

- Return on Equity (ROE): A rate of return of a rental property based on comparing the yearly cash flow to your total equity in that property.

- Return on Investment (ROI): A rate of return of a real estate transaction based on comparing the total profit from your investment to the total invested cash.

- Internal Rate of Return (IRR): An average annualized rate of return on your total invested cash.

- Rent to Value Ratio (RTV, RTP): A rate of return of a rental property based on comparing the monthly gross rent to the purchase price or market value.

- Gross Rent Multiplier (GRM): A rate of return of a rental property based on comparing the purchase price or market value to the yearly gross rent.

- Equity Multiple: A ratio that shows the total rate of return of a rental property based on comparing the total profit from your investment to the total invested cash.

- Break-Even Ratio (BER): A ratio that shows the minimum percentage of occupancy needed to cover all operating expenses and debt service obligations for a rental property.

- Loan to Cost Ratio (LTC): A ratio between the loan amount and the acquisition costs of a property.

- Loan to Value Ratio (LTV): A ratio between the loan amount and the market value of a property.

- Debt Coverage Ratio (DCR, DSCR): A ratio that compares a property’s yearly net operating income (NOI) to its yearly debt service – the total principal and interest payments on the loan.

- Debt Yield: A ratio that compares a property’s yearly net operating income (NOI) to the total loan amount.

Analysis Assumptions:

- Vacancy Allowance: A percentage of time you expect a rental property to remain vacant.

- Value Appreciation: An annual percentage increase of the market value of a property.

- Income Increase: An annual percentage increase of the operating income generated by a rental property.

- Expenses Increase: An annual percentage increase of the operating expenses you will have while renting out a property.

- Holding Period: The amount of time you anticipate it will take to rehab a property.

- Rehab Budget Contingency: An anticipated percentage increase of the rehab budget beyond the originally planned amount.